42+ what percent of income should mortgage be

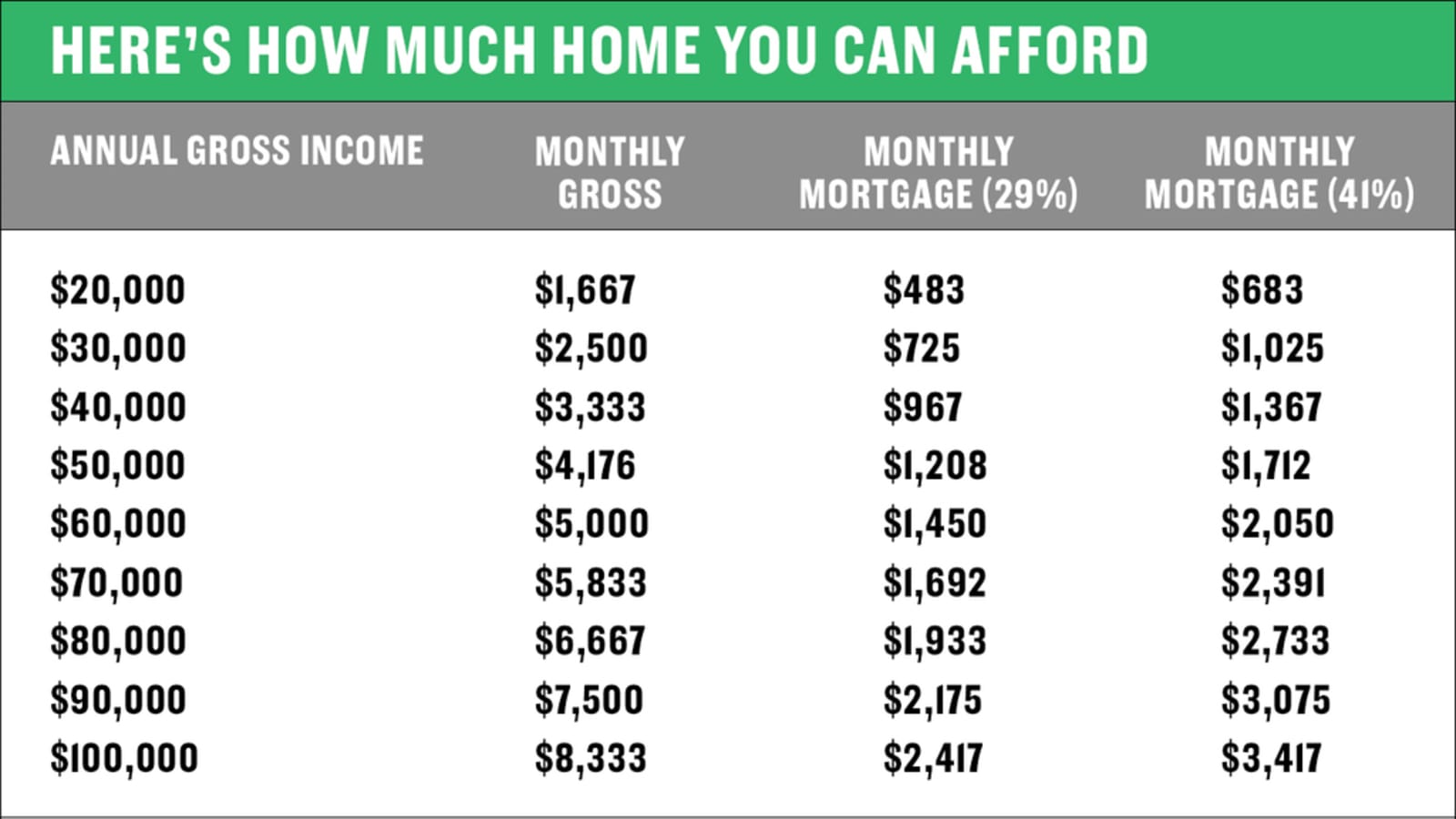

Web But with most mortgages lenders will want you to have a DTI of 43 or less. For example say you have a monthly gross income of 5000.

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

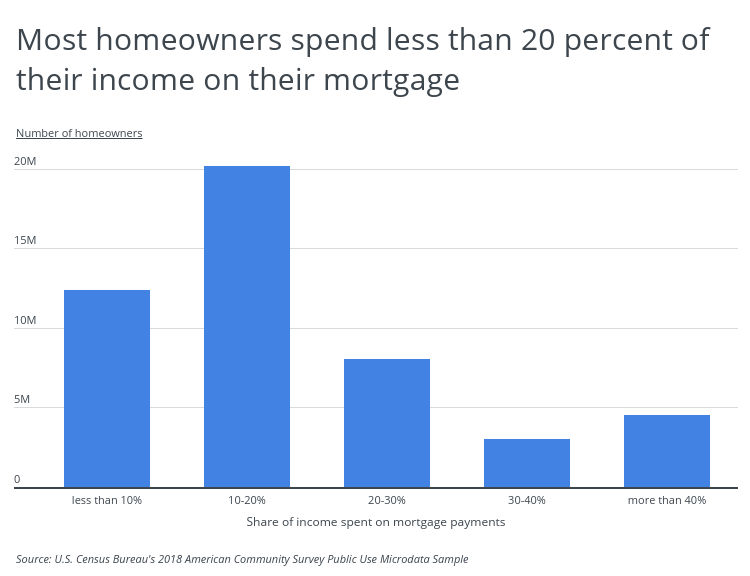

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

. Find A Lender That Offers Great Service. Apply Now With Quicken Loans. Ad Compare More Than Just Rates.

You already pay 1000. Get The Service You Deserve With The Mortgage Lender You Trust. Web But there are two other models that can be used.

John in the above example makes. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Based on surveys conducted for the past 20 years by national pollster.

Ad Compare More Than Just Rates. So taking into account homeowners insurance and property taxes. Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web The 28 percent rule which specifies that no more than 28 percent of your income should be spent on your monthly mortgage payment is a threshold most.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. And you should make. Ad Compare Mortgage Options Calculate Payments.

Great Rates Low Closing Costs Free Pre-Qualification Process. Ad Well Help You Find the Loan that Meets Your Home Purchase or Refinancing Needs. Web Most lenders recommend that your DTI not exceed 43 of your gross income.

Compare Lenders And Find Out Which One Suits You Best. Web 3 hours agoWhen most Americans retire Social Security becomes an indispensable source of income. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term.

Get Your Estimate Today. Web This refers to the recommendation that you should not spend any more than 28 of your gross income on the total amount you pay for your mortgage monthly. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

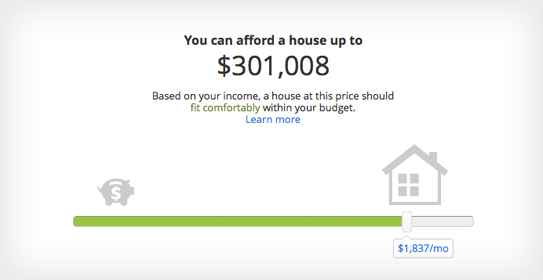

Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio. Looking For a House Loan. Ad 5 Best House Loan Lenders Compared Reviewed.

Get The Service You Deserve With The Mortgage Lender You Trust. Comparisons Trusted by 55000000. Ad Compare Mortgage Options Calculate Payments.

Get Your Estimate Today. Web A 15-year term. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

2 To calculate your maximum monthly debt based on this ratio multiply your. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Apply Now With Quicken Loans. Find A Lender That Offers Great Service.

Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web Following Kaplans 25 percent rule a more reasonable housing budget would be 1400 per month.

42 Sample Budget Checklists In Pdf Ms Word

Your Rent Should Be 10 Of Your Income How Much To Spend On Housing Johnnyfd Com Follow The Journey Of A Location Independent Entrepreneur

What Percentage Of Income Should Go To Mortgage

42 Profit And Loss Statement Template For Professional Business Reports Profit And Loss Statement Statement Template Bookkeeping Templates

What Percentage Of Annual Income Should Go To Rent

What Percentage Of Your Income To Spend On A Mortgage

Cities With The Highest Share Of Income Going Towards Mortgage Payments Hireahelper

Budget Percentages What Percentage Of Your Income Should Go To

How Much House Can You Afford Readynest

42 Sample Budget Checklists In Pdf Ms Word

Here S How To Figure Out How Much Home You Can Afford

What Percentage Of Income Should Go To A Mortgage Bankrate

What Percentage Of Income Should Go To My Mortgage Mares Mortgage

What Percentage Of Income Should Go To Mortgage Morty

Affordability Calculator How Much House Can I Afford Zillow

What Is Considered Good Salary In Los Angeles California For Family Of 4 Quora

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram